Between reviewing investor displays and firm paperwork, listening to earnings convention calls, and watching interviews, getting an correct valuation of an funding usually takes a whole lot of work.

One factor I love to do is analyze Deposits 13F. These are types filed by funding companies that handle greater than $100 million in shares. One of essentially the most well-known hedge funds is Ken Griffin’s Citadel. Last quarter, Citadel lowered its stake in Nvidia (NASDAQ:NVDA) by 79% — promoting 9,282,018 shares. In addition, the corporate elevated its place by 1,140% in Palantir Technologies (NYSE:PLTR)successful 5,222,682 shares.

Let’s dive deeper into what may need prompted Griffin and his portfolio managers to promote Nvidia and purchase Palantir. I’ll additionally discover what catalysts may assist gas much more development for Palantir and why now is perhaps a good time to comply with Griffin’s lead.

Why promote Nvidia now?

On the floor, promoting Nvidia inventory would possibly seem to be a questionable transfer. After all, is not synthetic intelligence (AI) the subsequent massive factor?

Well, even when AI seems to be the generational alternative it’s been rumored to be, that wouldn’t imply a lot at first look. There are many constructing blocks to AI, and Nvidia’s experience in creating superior chipsets referred to as graphics processing models (GPUs) is simply one of many many constructing blocks that energy AI.

The most bearish narrative surrounding Nvidia stems from rising competitors. Currently, merchandise developed by Advanced Micro Devices AND Intel are the obvious options to Nvidia. However, I see a higher danger within the aggressive panorama.

That is, Nvidia’s giant expertise cohorts, together with Tesla, Meta Platforms, MicrosoftAND Amazon they’re all investing heavily in developing their own hardwareGiven that many of those corporations are Nvidia prospects, I’m cautious about whether or not the corporate’s present development trajectory is sustainable in the long run.

As extra GPUs hit the market, there’s probability that the expertise will probably be handled as considerably of a commodity. Such a dynamic will probably result in decrease costs for Nvidia, which is able to in flip result in decrease revenues, margins, and income.

All issues thought of, I don’t blame Griffin for promoting such a big portion of his place in Nvidia. Despite the corporate’s success up to now, its future prospects appear probably questionable.

Why purchase Palantir now?

In a special space of the AI panorama is enterprise software program firm Palantir. It presents 4 knowledge analytics platforms referred to as Foundry, Gotham, Apollo, and AIP. The firm’s software program is utilized in quite a lot of use instances within the U.S. army and the non-public sector.

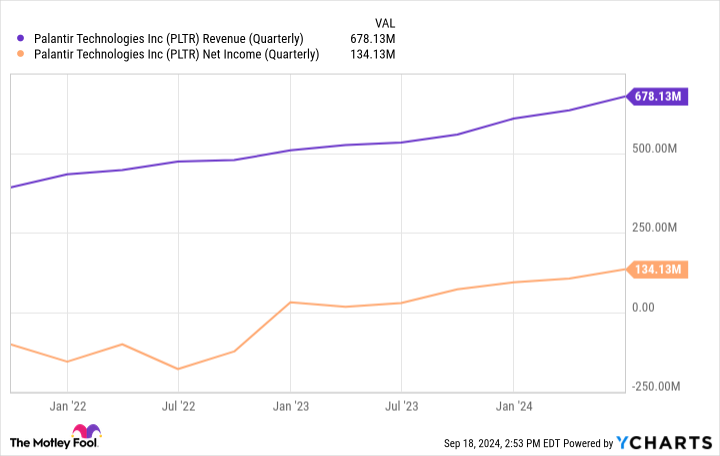

Investors can see that over the previous two years, Palantir’s income has accelerated towards the backdrop of a bullish AI narrative. More importantly, the corporate’s working leverage has improved considerably within the type of margin growth and regular profitability.

Earlier this month, Palantir additionally reached the notable milestone of inclusion within the S&P 500 Index.

Should You Buy Palantir Stock Now?

I can’t say for positive why Griffin elevated his stake in Palantir a lot final quarter, however I discover the timing fascinating for one purpose. Palantir had beforehand been eligible for the S&P 500, however was initially not chosen. Perhaps some felt that Palantir’s new development was merely an extension of demand for AI software program and wouldn’t be sustainable in the long run.

Regardless, I feel anybody who has adopted Palantir for a very long time would have realized that the corporate’s long-term prospects appeared strong, whatever the present narrative about AI. With that in thoughts, it was affordable to assume that the corporate would finally be included within the S&P 500.

This brings me to a broader level. Now that Palantir is within the S&P 500, there’s a good probability that extra funding banks and analysis analysts will begin following the corporate extra intently. In flip, this might result in extra institutional traders shopping for the inventory. Over time, this might strengthen Palantir’s model and notion within the funding neighborhood and drive the inventory to even greater costs.

I feel there’s a good probability that Palantir will see a surge in institutional possession. The firm is shortly rising as a drive within the AI software program enviornment and has even attracted corporations like Microsoft and Oracle — two relationships that I imagine will convey additional development to the corporate.

I see even higher days forward for Palantir and assume it is a nice time to purchase the inventory. With so many catalysts fueling the corporate’s upside, I see Griffin swapping Nvidia for Palantir as a very good transfer.

Should You Invest $1,000 in Palantir Technologies Right Now?

Before shopping for Palantir Technologies inventory, think about the next:

THE Motley Fool Stock Advisor The group of analysts has simply recognized what they imagine to be the 10 best stocks for traders to purchase now… and Palantir Technologies wasn’t one among them. The 10 shares that made the reduce may produce monstrous returns within the coming years.

Consider when Nvidia made this listing on April 15, 2005… in case you have invested $1,000 on the time of our suggestion, you’ll have $710,860!*

Stock Advisor offers traders with an easy-to-follow blueprint for achievement, together with a information to constructing a portfolio, common analyst updates, and two new inventory picks every month. Stock Advisor the service has greater than quadrupled the S&P 500’s comeback since 2002*.