Owned by the Kremlin energy giant Gazprom suffered a collapse in earnings within the North Sea final yr as sanctions and sudden income taxes hit the enterprise.

Gazprom UK, owned by the Russian authorities, noticed pre-tax earnings fall from €45m (£37.6m) in 2022 to €4m final yr, based on accounts filed at Companies House.

The firm paid 1.7 million euros in dividends to its Russian father or mother firm by way of a Dutch subsidiary, down from 41 million euros a yr earlier.

Gazprom UK has been producing gasoline from the Sillimanite discipline, which extends into British and Dutch waters, since 2020 in a three way partnership with German firm Wintershall.

However, he introduced plans to promote his stake in March, two years after Vladimir Putin’s invasion of Ukraine triggered a wave of Western sanctions that crippled the Kremlin’s exports.

The firm’s British subsidiary had benefited from hovering power costs following the battle, which helped the corporate, Russia’s largest taxpayer, to send millions to the Kremlin in 2021 and 2022.

The UK accounts, submitted a day late, had been printed months after the father or mother firm suffered its first annual loss in additional than 20 years because of declining gasoline commerce with Europe.

“The lower in earnings was primarily because of decreased manufacturing volumes,” the British firm mentioned in filings.

The accounts additionally present that almost all of Gazprom’s earnings within the UK had been devoured by the tax on energy profits launched by Rishi Sunak when he was chancellor, with funds totaling £2.9 million for the reason that tax was applied in May 2022.

The Russian president has additionally imposed a further manufacturing tax on Gazprom in Russia till 2025, because the latter struggles to proceed financing the battle.

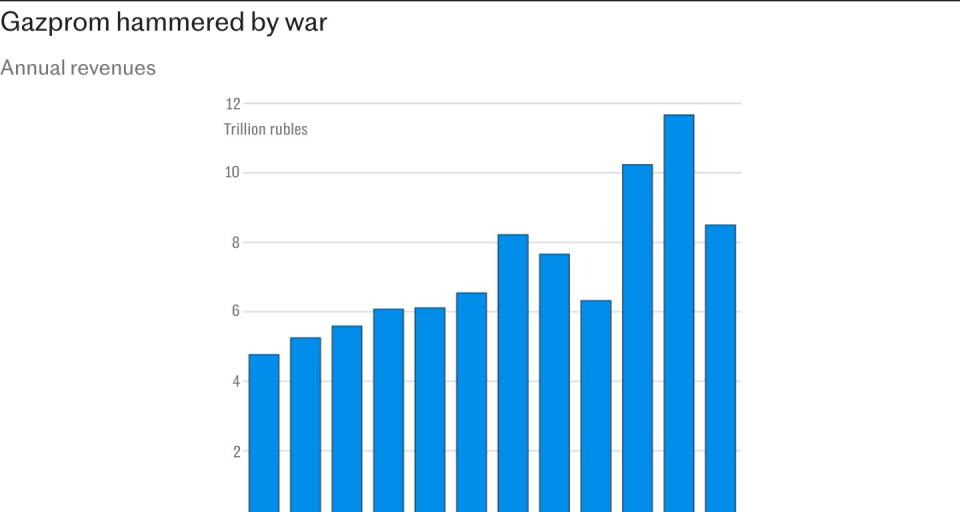

The findings spotlight the dramatic decline of Gazprom, which was certainly one of Russia’s strongest firms after the collapse of the Soviet Union.

A report commissioned by firm leaders and launched this summer time predicted that revenues had been unlikely to exceed pre-war ranges for a minimum of a decade, with gasoline exports to Europe barely reaching a 3rd of pre-war ranges by 2035 .

“The important consequence of the sanctions for Gazprom and the power trade is the contraction of export volumes, which shall be introduced again to 2020 ranges no sooner than 2035,” the authors of the doc write.