BEE

BEEDonald Trump has promised massive modifications for the world’s largest economic system.

On the agenda are “an finish to the devastating inflation disaster,” tariffs and large cuts in taxes, regulation and the dimensions of presidency.

This mixture, he says, will set off an financial increase and revive religion within the American dream.

“We are initially of an amazing, lovely golden age of enterprise,” he promised from the rostrum at Mar-a-Lago earlier this month.

But warnings loom over the president-elect that lots of his insurance policies usually tend to harm the economic system than assist it.

And as he prepares to place his plans into motion, analysts say he’s about to run into political and financial realities that may make it tough for him to maintain all his guarantees.

“There isn’t any clear path proper now on learn how to obtain all of those objectives as a result of they’re inherently contradictory,” stated Romina Boccia, director of funds coverage and entitlements on the Cato Institute.

Here’s a more in-depth take a look at its key guarantees.

Counter inflation

What Trump promised:

“Prices will go down,” he repeated a number of occasions.

It was a dangerous promise: costs not often drop except there may be an financial disaster.

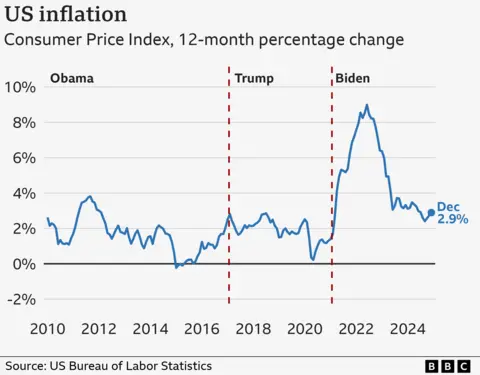

Inflation, which measures not value ranges however the price of value will increase, has already fallen considerably, though proving tough to get rid of fully.

What complicates it:

Trump attributed his assertion to a promise to broaden already report US oil and gasoline manufacturing whereas decreasing vitality prices. But the forces that affect inflation and vitality costs are largely outdoors presidential management.

To the extent that White House insurance policies make a distinction, analysts have warned that lots of Trump’s concepts – together with tax cuts, tariffs and migrant deportations – danger making the issue worse.

Economist John Cochrane of the right-wing Hoover Institution stated the large query dealing with the economic system is how Trump will navigate the “pressure” between the extra conventional pro-business elements of his coalition and the “nationalists” which deal with points similar to border management. and rivalry with China.

“Clearly each camps cannot get what they need,” he stated. “That’s going to be the core story and that is why we do not know what is going on to occur.”

What Trump voters need:

Inflation guarantees had been key to Trump’s victory, however in lots of respects, similar to progress and job creation, the general economic system was not within the dire straits described through the marketing campaign.

After his victory, he sought to decrease expectations, warning that it could be “very tough” to decrease costs.

Amanda Sue Mathis, 34, of Michigan, says she thinks Trump’s guarantees are doable however might take time.

“If there’s anybody who could make higher offers to make issues extra inexpensive for Americans, it is Donald Trump,” he stated. “He actually wrote the e book on the artwork of closing offers.”

Amanda Sue Mathis

Amanda Sue MathisImposition of world tariffs

What Trump promised:

Trump’s most unorthodox financial promise has been to impose tariffs – a border tax – of no less than 10% on all items coming into the United States, rising to greater than 60% for merchandise from China.

It has since stepped up threats in opposition to particular nations, together with allies similar to Canada, Mexico and Denmark.

Some Trump advisers have prompt that tariffs are negotiating instruments for different points, similar to border safety, and Trump will in the end accept a extra focused, gradual strategy.

What complicates it:

The debate has raised hypothesis about how aggressive Trump will determine to be given the potential financial dangers.

Analysts say the tariffs will possible result in increased costs for Americans and ache for firms hit by overseas retaliation.

And not like Trump’s first time period, any measures will come at a fragile time, because the long-running U.S. financial growth seems to be in its remaining phases.

Even if harder tariffs by no means materialize, the political debate alone is producing uncertainty that would depress funding and cut back progress within the United States by as a lot as 0.6% by mid-2025, in accordance with Oxford Economics.

“They have a really restricted margin for error,” Michael Cembalest, president of market and funding technique at JP Morgan Asset Management, stated in a current podcast. He warned that the need for a serious overhaul might “break one thing,” though it stays to be seen what.

Trade lawyer Everett Eissenstat, who served as a White House financial adviser throughout Trump’s first time period, stated he anticipated a blanket tariff however acknowledged the plan would compete with different objectives.

“There are all the time tensions. There isn’t perfection on the planet of politics. And clearly one of many causes I feel he bought re-elected is issues about inflation,” he stated.

“We are in a distinct world (in comparison with the primary time period) and we should see the way it seems,” he stated.

What Trump voters need:

Longtime Republican Ben Maurer stated he would really like Trump to deal with the broader aim of reviving U.S. manufacturing, fairly than the tariffs themselves.

“I really feel like that is extra of a negotiating tactic than an precise political path,” stated the 38-year-old, who lives in Pennsylvania.

“I’m not saying he will not impose tariffs on something – I feel he’ll – however I feel it will likely be extra strategic to determine precisely what to impose tariffs on. I assist him and really feel his judgment is sweet sufficient to determine what tariffs.”

Ben Maurer

Ben MaurerLower taxes, minimize spending

What Trump promised:

He laid out a plan for progress: decrease taxes, much less regulation and a smaller authorities, which he says will unleash American enterprise.

What complicates it:

But analysts say the regulatory rollback might take longer than anticipated. And Trump is predicted to prioritize extending expiring tax cuts over chopping spending.

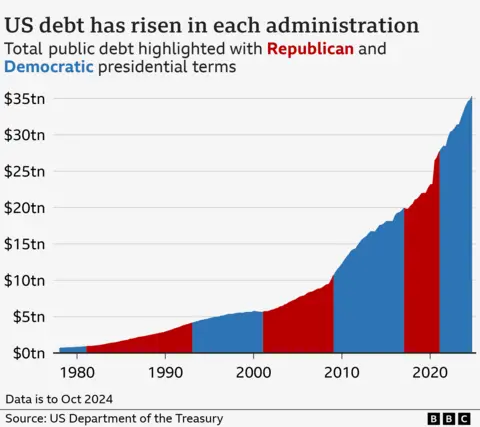

Ms. Boccia of the Cato Institute stated she anticipated borrowing to extend beneath the Trump administration and that the rise would add to inflationary pressures.

In monetary markets, these issues have already contributed to rising rates of interest on authorities debt in current weeks, he famous.

While Trump may even face some resistance from these inside his celebration who’re involved about America’s already excessive debt, Boccia stated extending the tax cuts – that are anticipated so as to add greater than $4.5 trillion of {dollars} to American debt over the subsequent decade – appears virtually sure.

By distinction, Trump declared a lot of the funds off-limits throughout his marketing campaign when he promised to depart massive applications, similar to Social Security, unchanged.

The so-called Department for Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy, has additionally publicly scaled again its ambitions.

“The alerts that the market is sending proper now are being picked up by economists however probably not by Washington,” he stated. “In the tip, politically it is taking the trail of least resistance.”

What Trump voters need:

Maurer stated chopping crimson tape is essential to his hopes for the administration.

“Government spending is absolute insanity,” he stated.

Additional reporting by Ana Faguy