The Panelists of the countdown Claman Kenny Polcari and John Staltzfus analyze how the market will reply to the large strikes.

The supervisor of the billionaire Ray Dalio warned in an interview on Sunday to be fearful concerning the financial system who lives one thing “worse than a recession” if the business battle triggers a break of the broader monetary system.

Dalio, the Head of Investments in Chief of the biggest Hedge Fund on the earth, Bridgewater Associates, stated in an NBC apparition “Meet the press with Kristen Welker“The proven fact that the charges of President Donald Trump have been” very disruptive “and are” how you can launch rocks within the manufacturing system “.

Welker requested Dalio if Trump’s charges are more likely to trigger a recession, and he replied: “I believe we’re in a choice -making level at this second and really near a recession. And I’m fearful about one thing worse than a recession if this isn’t nicely managed”.

Dalio stated that whereas the recessions happen often, what appears to occur is “a lot deeper” as there’s a “discount of the financial order” that entails the greenback, along with a breakdown of the home and world order.

The billionaire supervisor of the Hedge Fund requires a US business settlement with China: “Win-Win”

The billionaire Ray Dalio instructed the NBC that the financial system may face one thing “worse than a recession” if the present opposite winds will not be nicely managed. (Hollie Adams / Bloomberg through Getty Images / Getty Images)

“These moments are similar to the Nineteen Thirties,” Dalio stated.

“I’ve studied the story and this repeats itself over and over. So should you take charges, should you take the debt, should you take the rising energy by difficult the present energy, should you take these elements, these adjustments within the orders, the programs, they’re very, very disruptive.”

Welker adopted and requested him for his prediction of the place the nation is being directed, after having credited Dalio for having accurately foreseen the 2008 monetary disaster. Dalio noticed that the Federal Government of the United States is in a vital second with its price range deficit, which has been anticipated to extend to 7% of the gross home product (GDP) if the tax and expenditure insurance policies will not be reformed.

The billionaire director of the Hedge Fund warns of “Economic Heart Attack” for the United States financial system

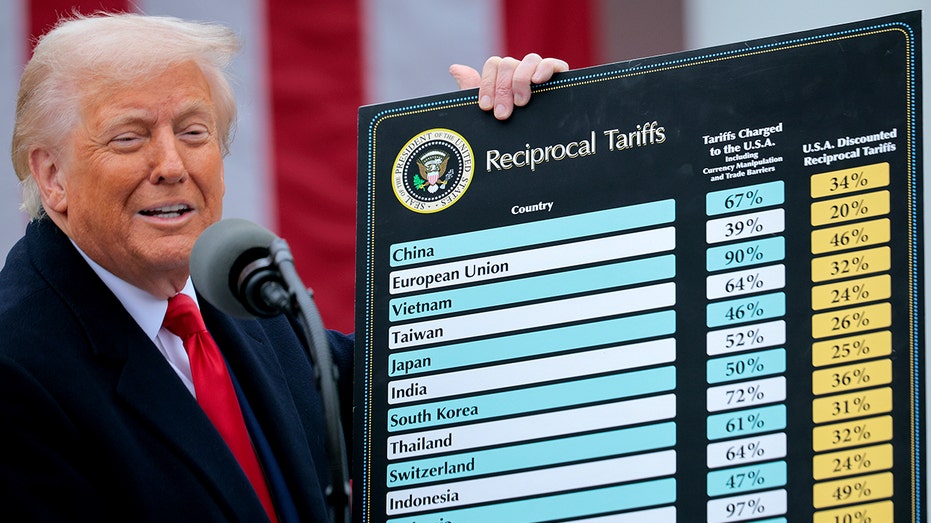

President Donald Trump has introduced giant charges on US business companions. (Somodevilla / Getty photos chip photos / Getty photos)

“If it could possibly be diminished to about 3% of GDP and these business deficits and so forth they’re managed in the fitting means, this could possibly be managed very nicely,” Dalio defined, including that the members of the congress is encouraging to cut back the deficit to three% of the GDP.

Dalio has outlined methods for politicians to stabilize the debt at that degree and requested the congress to face the matter in a bipartisan means as within the 90s, when the federal authorities managed a surplus.

He added that if the United States doesn’t stabilize the deficit, it’s going to in all probability trigger rates of interest on nationwide debt to extend and exacerbate the nation’s tax and financial challenges.

CBO states that the US price range deficits increase, nationwide debt to extend 156% of GDP

The charges are taxes on imported belongings which can be paid by the importer, which regularly transmits these larger prices for shoppers by larger costs. (Qian Weizhong / VCG through Getty Images / Getty Images)

“If they don’t do it, we could have a query of demand/supply for debt concurrently wherein we have now these different issues. And the outcomes of this will likely be worse than a standard recession,” stated Dalio.

Welker has requested Dalio in one other follow-up demand what he considers a worst situation for the financial system.

“To be very particular, the worth of cash, the inner battle that isn’t regular democracy as we all know it and the worldwide battle in a really disruptive means for the world financial system and will even be a army battle simply as these faults have occurred earlier than,” stated Dalio.

Get Fox Business touring by clicking right here