BBC Business Reporter

Global actions have been sunk, at some point after President Donald Trump has introduced massive new charges that’s anticipated to extend costs and weigh on development within the United States and overseas.

The fairness markets within the Asia-Pacific area fell for a second day, heat within the wake of the United States of the United States, which had its worst day since Covid crashed the economic system in 2020.

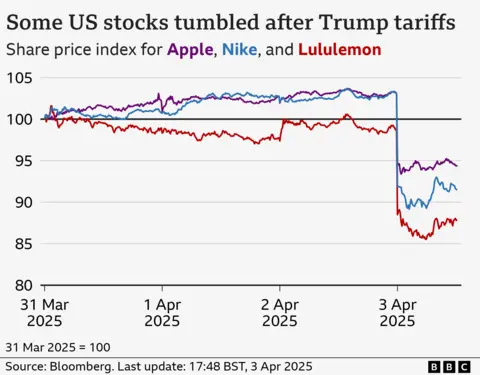

Nike, Apple and Target had been among the many massive names of the worst shoppers, all sinking by over 9%.

At the White House, Trump advised journalists that the American economic system would “increase” due to the minimal price of 10% who intends to slap international imports within the hope of accelerating federal revenues and bringing the American manufacturing home.

The Republican President plans to hit dozen merchandise from different nations with a lot larger withdrawals, together with business companions comparable to China and the European Union.

China, which is dealing with an mixture price of 54%, and the EU, which has 20percenttasks, promised each retaliation on Thursday.

French President Emmanuel Macron requested European firms to droop deliberate investments within the United States.

The charges are taxes on the products imported from different nations and the Trump plan that introduced on Wednesday would have elevated such duties to among the highest ranges in over 100 years.

The World Commerce group mentioned he was “deeply frightened”, estimating that business volumes might consequently be lowered by 1% this 12 months.

Traders expressed concern about the truth that the charges might feed inflation and development of blocking.

On Friday, within the Nikkei 225 index of Japan, the Nikkei 225 index decreased by 2.7% and the Australian Asx 200 decreased by 1.6%. The Kospi in South Korea was barely decrease.

Markets in continental China and Hong Kong are closed for the Qingming Festival.

Thursday, the S&P 500 – which holds a hint of 500 of the most important American firms – collapsed by 4.8%, shedding a price of about $ 2 TN.

The Dow Jones closed about 4% much less, whereas the Nasdaq collapsed by about 6%. The Sell-off of US actions has been underway since mid-February among the many fears of the business warfare.

Previously, the United Kingdom FTSE 100 shares index dropped by 1.5% and different European markets additionally decreased, echoing down from Japan to Hong Kong.

Thursday on the White House, Trump doubled in a excessive -level transfer aimed toward inverting many years of liberalization guided by the United States who modeled the worldwide business order.

“I feel he is going very nicely,” he mentioned. “It was an operation like when a affected person is managed, and it is an vital factor. I mentioned it will be precisely that approach.”

He added: “The markets will increase will go. The inventory is for increase. The nation stands for increase.”

In contradiction with the assistants of the White House that insisted on the brand new charges weren’t a negotiating tactic, Trump reported that it could possibly be open to an settlement with the business companions “if somebody advised that we provides you with one thing so phenomenal”.

Thursday, Canadian Prime Minister Mark Carney mentioned that the nation would react with a 25% pattern on autos imported from the United States.

Trump final month imposed 25% charges on Canada and Mexico, though he didn’t announce new duties on Wednesday in opposition to North American business companions.

Companies now face the selection to swallow the tariff value, work with companions to share that burden or transmit it to shoppers and threat a decline in gross sales.

This might have a exceptional influence because the expense for the US shopper quantities to about 10% – 15% of the world economic system, based on some estimates.

While the actions decreased on Thursday, the value of gold, which is seen as a safer asset in turbulence instances, touched a most report of $ 3,167.57 at a sure level on Thursday, earlier than falling again.

The greenback has additionally weakened in opposition to many different currencies.

In Europe, charges might drag the expansion of virtually a share level, with an additional blow if the blockade is avenged, based on analysts of the principle asset administration.

In the United States, a recession is more likely to materialize with out different modifications, comparable to the nice tax cuts, which Trump has additionally promised, warned SEMA SHAH, a world strategist of the corporate.

He mentioned that Trump’s objectives to boost manufacturing can be a “if occurred” course of.

“In the meantime, robust charges on imports are more likely to be fast resistance on the economic system, with a brief -term restricted benefit,” he mentioned.

Thursday, Stellantis, who produces Jeep, Fiat and different manufacturers, mentioned that he was quickly stopping manufacturing in a Toluca, Mexico and Windsor manufacturing unit, Canada.

He mentioned that the transfer, a tax response of 25% Trump on automobiles imports, would additionally result in momentary layoffs of 900 individuals in 5 vegetation within the United States who present these factories.

On the inventory market, Nike, which is most of his sportswear in Asia, was among the many most affected on the’s & p, with actions down by 14%.

Apple’s shares, that are primarily based closely on China and Taiwan, collapsed by 9%.

Other retailers additionally fell, with goal about 10%.

The Harley-Davidson-Ci bike producer was the topic of retaliation charges by the EU throughout the first time period of Trump as president-decreased by 10%.

In Europe, the shares of the Adidas sportswear firm decreased by over 10%, whereas the shares in rival puma collapsed by greater than 9%.

Among the businesses of luxurious items, the Pandora jewellery producer dropped by greater than 10% and LVMH (Louis Vuitton Moet Hennessy) fell greater than 3% after the charges had been imposed on the European Union and Switzerland.

“You are seeing that retailers are destroyed proper now as a result of the charges prolonged to the nations that we didn’t anticipate,” mentioned Jay Woods, a world technique garment at Freedom Capital Markets, including that he anticipated extra turbulence prematurely.